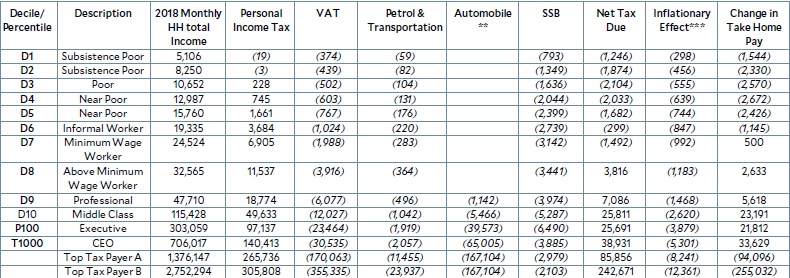

This table, from the Department of Finance, shows its estimates of

the combined impact of the “TARA sa TRAIN” (Tax Administration Reform

Act, Tax Reform for Acceleration and Inclusion) on Filipino households

(hh).

The first column breaks down the households by decile (definition:

each of 10 equal groups into which a population can be divided according

to the distribution of values of a particular variable, which in this

case is household income). Thus, you have the column listing from D1 to

D10. The highest income decile (D10) is further broken down into the top

1 percent (P100), and even further into the top 0.1 percent (P1,000).

This further subdivision is done so we can see what the tax reform does

to this elite class.

The second column describes the characteristics of each of the

deciles. Note that the bottom 50 percent of income earners are either

“Subsistence Poor,” “Poor” or “Near Poor.” Note that the “Minimum Wage

Worker” comes in the seventh decile, and the highest (tenth) income

decile is only where the “Middle Class” begins.

Saturday, July 29, 2017

Wednesday, July 19, 2017

What the legislature grants, it can take away

While queuing for more than an hour just to

catch a ride home, I noticed commuters in front of me giggling while

staring at their smartphones with earphones on. I subtly leaned in to

find out what was stirring their interest. On the screen, I saw the

familiar faces of Korean actors of a prime time soap opera. I realized

that the benefit of foreign telenovelas among Filipinos is that it helps

to keep them calm and entertained, especially city commuters who endure

hours of standing in line.

With the robust expansion of foreign influences into mainstream media as seen in drama series, K-pop songs and matinee idols (i.e., boy bands), we also see the enhancement of foreign relations between the Philippines, South Korea and the global community at large.

On the economic side, the Philippine government has incessantly endeavored to introduce measures that will increase foreign investment such as providing various fiscal and non-fiscal incentives to foreign investors. One example of these incentives is that specifically provided to regional operating headquarters (ROHQs).

As defined, an ROHQ is a resident foreign business entity which is allowed to derive income in the Philippines by performing qualifying services to its affiliates, subsidiaries or branches in the Philippines, in the Asia-Pacific region and in other foreign markets. Its operations are limited in the sense that it is merely allowed to perform the qualifying services enumerated in the Omnibus Investments Code of 1987, and only for its affiliates. Violation of these rules may result in the revocation of the ROHQ’s license or registration, and effectively, its tax exemptions and incentives.

WHAT EXACTLY ARE THE INCENTIVES PROVIDED BY OUR GOVERNMENT TO THESE ROHQS?

Generally, resident foreign corporations are subject to the 30% corporate income tax. However, as provided in the Tax Code, an ROHQ is liable to income tax at the special rate of 10% based on its taxable income. In addition, an ROHQ is also exempted from the payment of all kinds of local taxes, fees, or charges imposed by the local government, except real property tax on land improvements and equipment. Likewise, it is entitled to a tax and duty-free importation of equipment and materials used for training and conferences.

Moreover, several incentives are also given to expatriate employees of an ROHQ. These include the grant of a multiple entry visa for the expatriate employee including his spouse and unmarried children below the age of 21, tax and duty-free importation of personal and household effects, and travel tax exemption. Most importantly, a preferential tax rate of 15% applies on the salaries, annuities, and all other compensation of expatriates occupying managerial and technical positions exclusively working for the ROHQ and earning a gross annual taxable compensation of at least P975,000. The same treatment applies to Filipinos employed and occupying the same position as those aliens employed by the ROHQ.

Given the huge tax savings and various non-pecuniary benefits profusely provided by the Philippine government, many foreign corporations opted to establish their ROHQs in the Philippines resulting in a boost to foreign investment. This further translated to a rise in job opportunities for highly skilled workers, enticement for highly desirable employees, and a reduction in the risk of brain drain, among others.

A significant change in the incentives provided to ROHQs is being proposed in the Tax Reform for Acceleration and Inclusion (TRAIN) Bill passed by the House on May 31. Section 7 of the TRAIN Bill amends Section 25 of the National Internal Revenue Code of 1997. Specifically, the Bill deletes the 15% preferential tax rate provided to ROHQ employees occupying managerial and technical positions.

WHAT DOES THE REMOVAL OF THIS PREFERENTIAL TAX RATE MEAN FOR ROHQ EMPLOYEES?

Evidently, the ROHQ employees’ taxable income will then be subject to the normal graduated income tax rates of 0% to 35% applicable to all employees, as proposed by the TRAIN Bill. Those previously enjoying the preferential income tax rate of 15%, given the gross annual income of at least P975,000, will most likely qualify for the 30% to 35% income tax rates. The effective tax rate would, of course, be lower than 30% to 35%, but it would definitely be more than the current 15% rate. Consequently, this would result in reduced take-home pay for such employees if there is no augmentation in their gross compensation.

It is also worth noting that the TRAIN Bill is just the first part of the Tax Reform Program of the Philippine government. The second package intends to review and amend the income taxes on corporations, among others. Thus, it is possible that the 10% special income tax rate provided to ROHQs may also be amended or totally removed.

Some may argue that these reforms will produce unfavorable outcomes for the Philippine economy. Nonetheless, we must always bear in mind that the power of taxation is solely vested in the legislature. It is only Congress, as delegates of the people, which has the inherent power not only to select the subjects of taxation but to grant incentives and exemptions. Given the power to grant, it also has the inherent power to take away. We just have to trust that this move is consistent with the goal of the Tax Reform Program of achieving “efficiency, equity and simplicity” in our tax system and eventually benefit the entire population in the near future.

The views or opinions presented in this article are solely those of the author and do not necessarily represent those of Isla Lipana & Co. The firm will not accept any liability arising from the article.

Abigael Demdam is a senior consultant at the Tax Services Department of Isla Lipana & Co., the Philippine member firm of the PwC network. Readers may call +63 (2) 845-2728 or e-mail the author at abigael.demdam@ph.pwc.com for questions or feedback.

source: Businessworld

With the robust expansion of foreign influences into mainstream media as seen in drama series, K-pop songs and matinee idols (i.e., boy bands), we also see the enhancement of foreign relations between the Philippines, South Korea and the global community at large.

On the economic side, the Philippine government has incessantly endeavored to introduce measures that will increase foreign investment such as providing various fiscal and non-fiscal incentives to foreign investors. One example of these incentives is that specifically provided to regional operating headquarters (ROHQs).

As defined, an ROHQ is a resident foreign business entity which is allowed to derive income in the Philippines by performing qualifying services to its affiliates, subsidiaries or branches in the Philippines, in the Asia-Pacific region and in other foreign markets. Its operations are limited in the sense that it is merely allowed to perform the qualifying services enumerated in the Omnibus Investments Code of 1987, and only for its affiliates. Violation of these rules may result in the revocation of the ROHQ’s license or registration, and effectively, its tax exemptions and incentives.

WHAT EXACTLY ARE THE INCENTIVES PROVIDED BY OUR GOVERNMENT TO THESE ROHQS?

Generally, resident foreign corporations are subject to the 30% corporate income tax. However, as provided in the Tax Code, an ROHQ is liable to income tax at the special rate of 10% based on its taxable income. In addition, an ROHQ is also exempted from the payment of all kinds of local taxes, fees, or charges imposed by the local government, except real property tax on land improvements and equipment. Likewise, it is entitled to a tax and duty-free importation of equipment and materials used for training and conferences.

Moreover, several incentives are also given to expatriate employees of an ROHQ. These include the grant of a multiple entry visa for the expatriate employee including his spouse and unmarried children below the age of 21, tax and duty-free importation of personal and household effects, and travel tax exemption. Most importantly, a preferential tax rate of 15% applies on the salaries, annuities, and all other compensation of expatriates occupying managerial and technical positions exclusively working for the ROHQ and earning a gross annual taxable compensation of at least P975,000. The same treatment applies to Filipinos employed and occupying the same position as those aliens employed by the ROHQ.

Given the huge tax savings and various non-pecuniary benefits profusely provided by the Philippine government, many foreign corporations opted to establish their ROHQs in the Philippines resulting in a boost to foreign investment. This further translated to a rise in job opportunities for highly skilled workers, enticement for highly desirable employees, and a reduction in the risk of brain drain, among others.

A significant change in the incentives provided to ROHQs is being proposed in the Tax Reform for Acceleration and Inclusion (TRAIN) Bill passed by the House on May 31. Section 7 of the TRAIN Bill amends Section 25 of the National Internal Revenue Code of 1997. Specifically, the Bill deletes the 15% preferential tax rate provided to ROHQ employees occupying managerial and technical positions.

WHAT DOES THE REMOVAL OF THIS PREFERENTIAL TAX RATE MEAN FOR ROHQ EMPLOYEES?

Evidently, the ROHQ employees’ taxable income will then be subject to the normal graduated income tax rates of 0% to 35% applicable to all employees, as proposed by the TRAIN Bill. Those previously enjoying the preferential income tax rate of 15%, given the gross annual income of at least P975,000, will most likely qualify for the 30% to 35% income tax rates. The effective tax rate would, of course, be lower than 30% to 35%, but it would definitely be more than the current 15% rate. Consequently, this would result in reduced take-home pay for such employees if there is no augmentation in their gross compensation.

It is also worth noting that the TRAIN Bill is just the first part of the Tax Reform Program of the Philippine government. The second package intends to review and amend the income taxes on corporations, among others. Thus, it is possible that the 10% special income tax rate provided to ROHQs may also be amended or totally removed.

Some may argue that these reforms will produce unfavorable outcomes for the Philippine economy. Nonetheless, we must always bear in mind that the power of taxation is solely vested in the legislature. It is only Congress, as delegates of the people, which has the inherent power not only to select the subjects of taxation but to grant incentives and exemptions. Given the power to grant, it also has the inherent power to take away. We just have to trust that this move is consistent with the goal of the Tax Reform Program of achieving “efficiency, equity and simplicity” in our tax system and eventually benefit the entire population in the near future.

The views or opinions presented in this article are solely those of the author and do not necessarily represent those of Isla Lipana & Co. The firm will not accept any liability arising from the article.

Abigael Demdam is a senior consultant at the Tax Services Department of Isla Lipana & Co., the Philippine member firm of the PwC network. Readers may call +63 (2) 845-2728 or e-mail the author at abigael.demdam@ph.pwc.com for questions or feedback.

source: Businessworld

Sunday, July 16, 2017

No deal

The tax evasion proceedings against homegrown cigarette manufacturer

Mighty Corp. is proving to be a test case in the Duterte

administration’s campaign to punish corporate offenders.

It has, we heard, already caused a rift between lawmakers and President Duterte’s officials.

Mighty’s offer to settle was finally made public last week by the Department of Finance, which is reviewing the proposal sent to its attached unit, the Bureau of Internal Revenue, which is the lead agency in the cigarette firm’s case.

In a July 10 letter to Internal Revenue Commissioner Caesar R. Dulay, Mighty president Oscar Barrientos indicated that the firm was willing to “settle all such excise and tax issues and respectfully offer as settlement of the company’s shareholders’ and its officers’ liability … the total sum of P25 billion.”

The BIR has filed three tax-evasion cases against Mighty at the Department of Justice for its alleged use of fake tax stamps in order to dodge payment of excise taxes. It estimated the unpaid taxes at P37.88 billion.

It has, we heard, already caused a rift between lawmakers and President Duterte’s officials.

Mighty’s offer to settle was finally made public last week by the Department of Finance, which is reviewing the proposal sent to its attached unit, the Bureau of Internal Revenue, which is the lead agency in the cigarette firm’s case.

In a July 10 letter to Internal Revenue Commissioner Caesar R. Dulay, Mighty president Oscar Barrientos indicated that the firm was willing to “settle all such excise and tax issues and respectfully offer as settlement of the company’s shareholders’ and its officers’ liability … the total sum of P25 billion.”

The BIR has filed three tax-evasion cases against Mighty at the Department of Justice for its alleged use of fake tax stamps in order to dodge payment of excise taxes. It estimated the unpaid taxes at P37.88 billion.

Barrientos

said the settlement sum would be funded by an interim loan from the

unit of Japan Tobacco Inc. (JTI) in the Philippines and the sale by

Mighty and its affiliates of its manufacturing and distribution business

and assets, along with the associated intellectual property rights,

including those owned by the company Wong Chu King Holdings Inc., and

other affiliates to JTI “for a total purchase price of P45 billion,

exclusive of VAT.” In effect, Mighty will cease operations after

concluding its deal with JTI.

Barrientos indicated that Mighty would pay P3.5 billion in deficiency

excise taxes on its cigarette products that are now the subject of the

three tax cases pending at the DOJ. Mighty would also remit P21.5

billion “representing the liabilities of the company and its

shareholders, as well as the company officers for all internal revenue

taxes, including income tax from 2010 to 2016 and the tax period up to

the closing of the proposed transaction with JTI, and all transaction

taxes related to the agreement with JTI.”

He said that the initial payment of P3.5 billion would be paid by Mighty on or before July 20, and that a binding memorandum of agreement in relation to the proposed transaction with JTI would be concluded before that date. The balance is to be paid upon or after the sale of Mighty to JTI.

After all these, Mighty wants the BIR to issue to the company and its shareholders and officers “the relevant certificate of availment of compromise, a final tax assessment for all the company’s excise and other tax issues described above, and relevant tax clearances to the company, its shareholders and officers,” Barrientos said.

Finance Secretary Carlos Dominguez III is correct to make it clear that any settlement offer by Mighty for its tax deficiencies should be separate from the criminal charges that might be filed in court by the BIR against it. Dominguez’s position that criminal liability should be left out of any settlement with Mighty is the alleged cause of disagreement between the cigarette firm and its backers in Congress on one hand, and the President’s economic team on the other.

Clearing Mighty of criminal liability under the proposed settlement will certainly weaken the government’s resolve to weed out unscrupulous businessmen who have been depriving the people of vital public services through nonpayment of taxes. Settlement with a company that underpaid its taxes without intending to—for example, due to a disparity in valuations—should be agreeable. But this should not be so for a company that deliberately evaded the payment of taxes by resorting to criminal acts like the use of fake tax stamps.

And just as a reminder, Section 263 of the Tax Code states that any person found in possession of locally manufactured articles subject to excise tax, the tax on which has not been paid in accordance with the law, shall be punished with a fine of not less than 10 times the amount of excise tax due, as well as imprisonment.

He said that the initial payment of P3.5 billion would be paid by Mighty on or before July 20, and that a binding memorandum of agreement in relation to the proposed transaction with JTI would be concluded before that date. The balance is to be paid upon or after the sale of Mighty to JTI.

After all these, Mighty wants the BIR to issue to the company and its shareholders and officers “the relevant certificate of availment of compromise, a final tax assessment for all the company’s excise and other tax issues described above, and relevant tax clearances to the company, its shareholders and officers,” Barrientos said.

Finance Secretary Carlos Dominguez III is correct to make it clear that any settlement offer by Mighty for its tax deficiencies should be separate from the criminal charges that might be filed in court by the BIR against it. Dominguez’s position that criminal liability should be left out of any settlement with Mighty is the alleged cause of disagreement between the cigarette firm and its backers in Congress on one hand, and the President’s economic team on the other.

Clearing Mighty of criminal liability under the proposed settlement will certainly weaken the government’s resolve to weed out unscrupulous businessmen who have been depriving the people of vital public services through nonpayment of taxes. Settlement with a company that underpaid its taxes without intending to—for example, due to a disparity in valuations—should be agreeable. But this should not be so for a company that deliberately evaded the payment of taxes by resorting to criminal acts like the use of fake tax stamps.

And just as a reminder, Section 263 of the Tax Code states that any person found in possession of locally manufactured articles subject to excise tax, the tax on which has not been paid in accordance with the law, shall be punished with a fine of not less than 10 times the amount of excise tax due, as well as imprisonment.

source: Philippine Daily Inquirer

Saturday, July 8, 2017

A Letter Notice cannot substitute for a Letter of Authority

Taxation is the lifeblood of the

government. Through the collected taxes, the government is able to fund

the increasing need of its people for infrastructure, education, health,

etc. The Bureau of Internal Revenue (BIR) is the Philippine

government’s largest revenue collecting arm. For this year alone, the

Bureau was assigned a P1.8 trillion tax collection target.

Throughout the years, the BIR has implemented various programs to improve its tax collection efforts. In 2003, it issued Revenue Memorandum Order (RMO) Nos. 30-2003 and 42-2003 which provided policies and guidelines to detect tax leaks by matching data from the BIR’s Integrated Tax System (ITS) and data from third party resources. Discrepancies generated through these matchings were used to unearth what could potentially be undeclared sales and/or over-claimed purchases by various taxpayers.

This “no-contact-audit approach” enables the BIR to use computerized matching to compare data from records or various returns filed by a taxpayer against those gathered from its suppliers or customers, and even those reported to other agencies, particularly the Bureau of Customs. Taxpayers with noted discrepancies are then informed of the findings through the issuance of a Letter Notice (LN) by the BIR. Consequently, such taxpayers are given 120 days to reconcile the inconsistencies; otherwise, deficiency taxes will be assessed.

In one of its recent decisions, the Supreme Court (SC) held that the absence of a Letter of Authority (LOA), makes the assessment unauthorized and thus, void. This is despite the prior issuance of an LN. According to the court, the BIR’s failure to issue an LOA constituted a violation of due process and was considered fatal to the tax audit.

The SC differentiated an LOA from an LN, noting that LNs only serve as notice of any discrepancy to the taxpayers and is not in any way a substitute for an LOA which grants authority to the revenue officers to examine the books of the taxpayers. The LN operates similarly to a Notice of Informal Conference, an erstwhile requirement which was removed from the BIR’s tax audit process when the Bureau issued its revised regulations for tax audits back in 2013.

The SC stressed that the BIR must issue an LOA prior to issuing a Preliminary Assessment Notice (PAN), a Final/Formal Assessment Notice (FAN), or a Final Decision on Disputed Assessment (FDDA) to the taxpayer; otherwise, the assessment is rendered void for lack of due process.

This decision overturns the earlier ruling of the Court of Tax Appeals (CTA) en banc which held that the LN in essence, can serve as proof of the revenue officer’s authority to examine the books of the taxpayer. The court pointed out that the taxpayer can no longer question the validity of the tax assessment on the ground of lack of an LOA since the BIR had provided the requisite legal and factual bases of the deficiency tax being assessed. In the higher interest of justice, the SC considered the absence of the LOA as fatal to the case, underscoring the importance of due process.

The SC’s decision to reverse the CTA ruling thereby effectively negates RMO No. 55-2010, which was issued by the BIR based on the earlier CTA ruling. As it is, the BIR has yet to issue guidelines on this recent decision by the SC.

Due process is a basic right guaranteed to all persons under the Philippine Constitution. It is an elementary rule that no person shall be deprived of property without due process of law. To boost taxpayers’ compliance with the tax laws and regulations, the government, through its tax authorities, must continually build trust and confidence among taxpayers and in the society in general.

The pronouncement of the SC brings to light, once again, the significance of due process in taxation. While it is imperative for the tax authorities to generate revenues through exaction of taxes, the government’s power to tax must be exercised with justice. This can only be achieved when collection of taxes exercised through programs are implemented with reasonable requirements and within the bounds of the law.

However steep the BIR’s collection target is, it must be reached only through acts that are within the bounds of the Bureau’s authority.

The views or opinions presented in this article are solely those of the author and do not necessarily represent those of Isla Lipana & Co. The firm will not accept any liability arising from the article.

Kathrine Joy S. Capales is an Assistant Manager at the Tax Services Department of Isla Lipana & Co., the Philippine member firm of the PwC network.

+63 (2) 845-2728

kathrine.joy.capales@ph.pwc.com

source: Businessworld

Throughout the years, the BIR has implemented various programs to improve its tax collection efforts. In 2003, it issued Revenue Memorandum Order (RMO) Nos. 30-2003 and 42-2003 which provided policies and guidelines to detect tax leaks by matching data from the BIR’s Integrated Tax System (ITS) and data from third party resources. Discrepancies generated through these matchings were used to unearth what could potentially be undeclared sales and/or over-claimed purchases by various taxpayers.

This “no-contact-audit approach” enables the BIR to use computerized matching to compare data from records or various returns filed by a taxpayer against those gathered from its suppliers or customers, and even those reported to other agencies, particularly the Bureau of Customs. Taxpayers with noted discrepancies are then informed of the findings through the issuance of a Letter Notice (LN) by the BIR. Consequently, such taxpayers are given 120 days to reconcile the inconsistencies; otherwise, deficiency taxes will be assessed.

In one of its recent decisions, the Supreme Court (SC) held that the absence of a Letter of Authority (LOA), makes the assessment unauthorized and thus, void. This is despite the prior issuance of an LN. According to the court, the BIR’s failure to issue an LOA constituted a violation of due process and was considered fatal to the tax audit.

The SC differentiated an LOA from an LN, noting that LNs only serve as notice of any discrepancy to the taxpayers and is not in any way a substitute for an LOA which grants authority to the revenue officers to examine the books of the taxpayers. The LN operates similarly to a Notice of Informal Conference, an erstwhile requirement which was removed from the BIR’s tax audit process when the Bureau issued its revised regulations for tax audits back in 2013.

The SC stressed that the BIR must issue an LOA prior to issuing a Preliminary Assessment Notice (PAN), a Final/Formal Assessment Notice (FAN), or a Final Decision on Disputed Assessment (FDDA) to the taxpayer; otherwise, the assessment is rendered void for lack of due process.

This decision overturns the earlier ruling of the Court of Tax Appeals (CTA) en banc which held that the LN in essence, can serve as proof of the revenue officer’s authority to examine the books of the taxpayer. The court pointed out that the taxpayer can no longer question the validity of the tax assessment on the ground of lack of an LOA since the BIR had provided the requisite legal and factual bases of the deficiency tax being assessed. In the higher interest of justice, the SC considered the absence of the LOA as fatal to the case, underscoring the importance of due process.

The SC’s decision to reverse the CTA ruling thereby effectively negates RMO No. 55-2010, which was issued by the BIR based on the earlier CTA ruling. As it is, the BIR has yet to issue guidelines on this recent decision by the SC.

Due process is a basic right guaranteed to all persons under the Philippine Constitution. It is an elementary rule that no person shall be deprived of property without due process of law. To boost taxpayers’ compliance with the tax laws and regulations, the government, through its tax authorities, must continually build trust and confidence among taxpayers and in the society in general.

The pronouncement of the SC brings to light, once again, the significance of due process in taxation. While it is imperative for the tax authorities to generate revenues through exaction of taxes, the government’s power to tax must be exercised with justice. This can only be achieved when collection of taxes exercised through programs are implemented with reasonable requirements and within the bounds of the law.

However steep the BIR’s collection target is, it must be reached only through acts that are within the bounds of the Bureau’s authority.

The views or opinions presented in this article are solely those of the author and do not necessarily represent those of Isla Lipana & Co. The firm will not accept any liability arising from the article.

Kathrine Joy S. Capales is an Assistant Manager at the Tax Services Department of Isla Lipana & Co., the Philippine member firm of the PwC network.

+63 (2) 845-2728

kathrine.joy.capales@ph.pwc.com

source: Businessworld

Friday, July 7, 2017

The bitter side of sugary-drinks tax

WHEN schools

started to ban soft drinks in their respective canteens some three years

ago, the teachers themselves started to smuggle in and hoard in their

respective drawers the very thing that they ask their students not to

consume.

They need the sugar to teach, some of

them say, not minding their school administration’s policies that also

affected them, as they cannot purchase soda drinks anymore within the

school premises.

This time around, as the Duterte

administration makes headway into its comprehensive tax-reform package,

called Tax Reform and Acceleration and Inclusion Act (TRAIN), a House

bill has been filed to slap tax on these sugary drinks as part of the

revenue-generation initiatives.

‘Antipoor’

A bill filed by Sultan Kudarat Rep.

Horacio Suansing Jr. and Nueva Ecija Rep. Estrellita Suasing seeks to

impose a P10 tax on sugar-sweetened beverages, the rate of which will be

increased every year by 4 percent.

That caught the attention of many

corporate chief executives, many of whom were previously silent whenever

the government plans to introduce new taxes. Some of these corporate

top honchos even called the move as antipoor.

“We have many concerns. First of all…it

affects the masses most. The proposed tax increase here is six times

what was proposed in Mexico. At the end, who are the primary consumers

of ready-to-drink beverages, it’s the masses of the Filipino people.

Just imagine if I drink one coffee a day and I have to pay P3 or P4 more

times 365, that’s P1,500 a year. That’s the breakfast of the masses,”

said Lance Gokongwei, president and CEO of food group Universal Robina

Corp. (URC).

Gokongwei, also president and COO of the

family’s holding firm JG Summit Holdings Inc., was referring to

Mexico’s same plans on sugar tax, but at a much lower rate.

“The effective increase we’re looking at

is P10 a liter in a per capita basis. The average capita per income

here is $3,000. We always cite Mexico. The effective tax there was P1.45

per liter in a country where capita per income was $10,000,” Gokongwei

said.

URC sells products such as C2 iced-tea

beverages, which at one time outsold Coke in the Philippines, and Great

Taste coffee mixes, among other sugary products. Its products are now

being sold across Southeast Asia, including in Vietnam, where it has a

manufacturing plant.

Sugar-sweetened beverages refer to

nonalcoholic drinks that contain caloric sweeteners, added sugar, or

artificial or noncaloric sweeteners. It may be in liquid form, syrup,

concentrates, or solid mixture added to liquids.

Revenue figures

Estimates of the Department of Finance

(DOF) foresee that a liter of Coke, now priced at P31 per bottle and

rival Pepsi 1.5 liters, being sold at P46.50, will go up by an average

of 36 percent.

A can of regular 330 milliliters of

Coke, for instance, contains some 34.5 grams of sugar and 136 calories,

which teachers say they can easily burn as they teach.

Although debatable, the amount of sugar

in a single drink can lead to obesity and some of the noncommunicable

diseases, such as Type-2 diabetes, blood sugar disorders and other

related illnesses.

The DOF, keen on passing the new tax

measure on health concerns rather than to generate additional cash,

estimates a revenue of between P40 billion and P47 billion after the

bill is passed into law.

The group Action for Economic Reform, a

non-governmental organization that helped lobby to pass the sin-tax law,

said it has not initiated a coalition yet on the sugar-tax issue like

what it did with the tobacco excise tax, but its allied organization,

such as the Philippine College of Physicians, has a stand on the issue.

It said, however, the bill needs more

study on how the P10-per-liter tax came about, but generally the group

has not yet moved significantly to push for the proposal, which is

posing more questions than answers to the industry.

For one, there are some concerns if the

government can really collect such amount when demand naturally drops

when a new tax is passed, then recover soon after.

Feasibility question

A study of the World Health Organization

(WHO) said taxing sugary drinks can lower consumption. The study said

fiscal policies that lead to at least a 20-percent increase in the

retail price of sugary drinks would result in proportional reductions in

consumption of such products, citing its report, titled “Fiscal

policies for Diet and Prevention of Noncommunicable Diseases”, published

late last year.

The Beverage Industry Association of the

Philippines, meanwhile, said such move can lead to a P20-billion

decline in sales of sugar-sweetened beverages as demand declines.

According to the Philippine Association

of Stores and Carinderia Owners, 80 percent of the consumers of these

products are low-income earners and 30 percent to 40 percent of the

income of sari-sari store owners comes from the sale of coffee, juice and carbonated drinks.

There are also concerns on how the government—the Bureau of Internal Revenue (BIR)—can monitor and administer such new measure.

According to the bill, the sugar-excise

tax will not be levied on the raw sugar production itself, but on the

products. An excise tax, which is an indirect tax charged on the sale of

a particular good, is normally being collected at the source of

product.

The excise tax on oil products and

vehicles, for instance, is being collected at the port of entry where it

will be discharged. For tobacco and alcohol products, the tax is being

collected at the manufacturing plants before these are shipped out to

the distributors or to the retailers.

Too high

Michael Tan, president and CEO of the LT

Group Inc., said not only is the rate too high, but it will be

impossible to administer such new tax measure at its current state.

“What will happen on the post mix in the restaurants or in Starbucks or in carinderia, how

do you tax that? They’ll put a coffee, they’ll put a sugar and sell it

over the counter. By definition, that’s excise-taxable. In

microbreweries, you brew in a pub and sell it to the customer, that

carries a tax. There should be a tax by their current definition and to

be consistent on the existing policies on alcohol,” Tan said.

The LT Group holds most of the

businesses of tycoon Lucio Tan, including PMFTC Inc., the combined

company of Philip Morris Philippines and Fortune Tobacco, and Asia

Brewery, which holds a stable of local and international beer brands and

alcohol-laced pop drinks such as Tanduay Ice.

When the new excise tax on the so-called

sin products was implemented during the Aquino administration, Tan was

vocal on his smuggling allegations against one of the players, Mighty

Corp., which is now being sued for smuggling and tax evasion.

“So from the manufacturing side,

cigarette factories, there are six cigarette manufacturing, they cannot

even manage to stop one. So this will be hundreds of beverage facilities

and I don’t think the BIR has the manpower to police it,” Tan said.

“So you will end up with the bigger

companies complying, and the smaller ones not complying. That’s only at

the factory level. What more at the retail level, at the post mix, like

the restaurants and bar,” he said.

The sugar planters, meanwhile, are

backing the increase to double the excise tax to P20 per liter on the

imported high fructose corn syrup (HFCS), a product also being used by

beverage companies to sweeten their drinks.

WTO issue

That proposal, meanwhile, has other

repercussions, especially on the possible allegations of protecting

local farmers, as the county is a signatory to the World Trade

Organization (WTO).

“We’re putting up an HFCS plant. It will

be operational soon and the input is corn. So how can you tax it

higher? There are more corn farmers in the Philippines than sugar

farmers. It’s a nonlocal gain. That’s an issue [for] WTO there. You

cannot discriminate, [otherwise] people will discriminate our pineapples

and banana if we do that,” Tan said.

Former Ambassador Alfredo Yao, now

chairman of Macay Holdings Inc., which owns the family’s carbonated

business that manufactures RC Cola and Zest-O drinks, the government

should instead tax the raw sugar itself and not the products.

“Then it’s a fair sharing; everybody

shares. Everybody shares and it will not be as abrupt as now and only

result to a peso [increase] per liter on specific industries only,” Yao

said.

“We have conveyed a message to the

congressmen. Now we are talking to the Senate. I hope they understand. I

think the government side will understand. We know where they’re coming

from. They need the taxes and all,” he said.

For now, the chief executives are still

studying their next moves if indeed the Duterte administration’s TRAIN,

which includes the sugar tax, can railroad their otherwise sweet

business.

source: Business Mirror

Subscribe to:

Posts (Atom)